Boy oh boy, what a hot topic right now! Let me throw out some ideas and you decide if now or later is a good time to buy, fair enough?

If we navigate over to a mortgage or amortization calculator (here is a free one I use, navigate to the amortization calculator option) we can throw in some numbers to explore a bit.

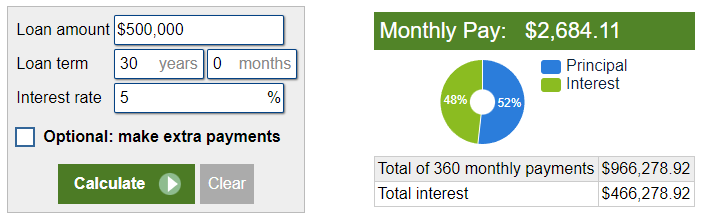

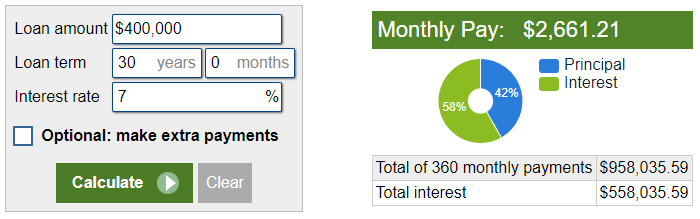

Taking a look at the numbers above, you’ll see that I made some assumptions to compare the P&I (Principle & Interest) payment portion of someone’s mortgage payment, which usually includes insurance & taxes rolled into one payment. If you could get a $400,000, 30 year loan at today’s (June 17th, 2024) interest rate of 7%, your monthly payment would be $2,661.21. Compare that to a $500,000, 30 year loan at 5% interest rate for the $2,684.11 a month at some date in the future we don’t know. I’m not an economist, but with the way the Fed’s have been lately, that is at best a few years out in my humble opinion. My pessimistic mindset is that is more like 5+ years, but who knows.

Where am I going with this?

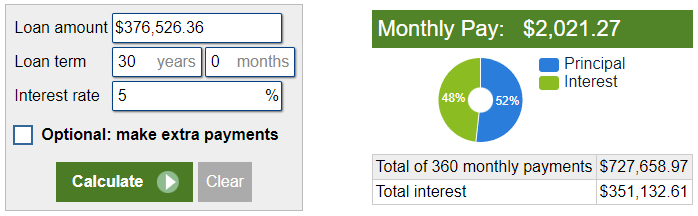

With the way the Nashville market has been, realistically, a $400k house could definitely be worth $500k within the next 5 years, especially if rates drop by 2%. If that scenario happened and you bought now, in 5 years, you’ll have $124,473.74 in equity as you’ve paid down your principle by $24,473.74 and gained $100k in equity. The beauty in this scenario is you could turn around and refinance that now $376,526.36 loan balance from a 7% interest rate to a 5% interest rate, making your new payment $2,021.27, a full $600+ a month less than it was a year ago.

On the flip side, you can’t refinance the $500,000, 30 year mortgage you waited 5+ years to acquire and your payment is now that $2,600+ a month, unless rates drop a lot more… which I don’t think they will!

Just something to think about.

Is this the whole “Date the rate, marry the house” saying you gave me? I get it.

Haha, yes! This is exactly what I was talking about.